Business Insurance in and around Sandy Springs

Calling all small business owners of Sandy Springs!

This small business insurance is not risky

Help Protect Your Business With State Farm.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Philip Cohn understands the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to explore.

Calling all small business owners of Sandy Springs!

This small business insurance is not risky

Customizable Coverage For Your Business

If you're looking for a business policy that can help cover loss of income, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

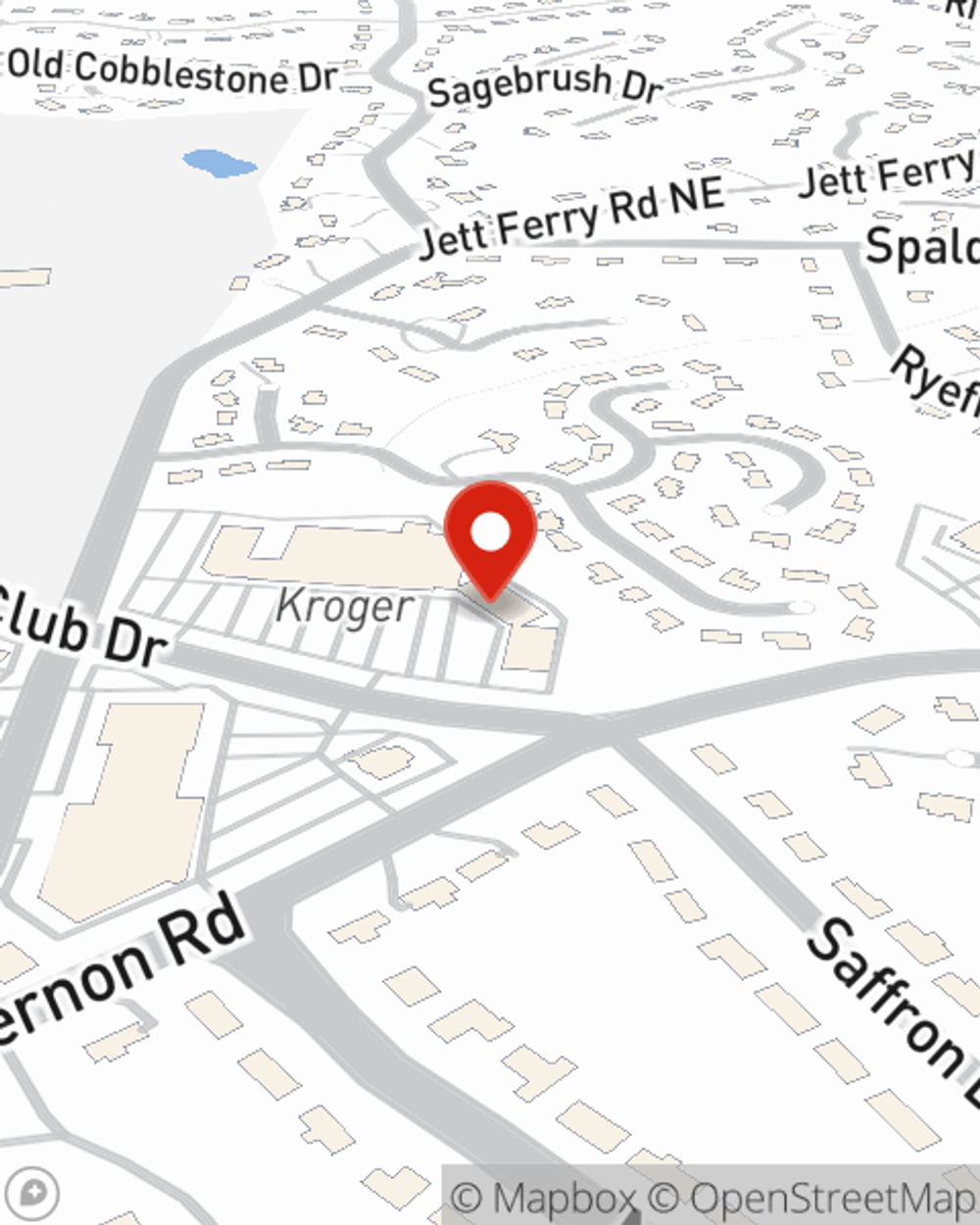

At State Farm agent Philip Cohn's office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Philip Cohn

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.